Whether you are planning on buying a yacht and sailing off in to the sunset, or if you have no intention of doing that but you do plan to retire at some stage – then this post is for you!

Saving for your retirement is a hot topic here in New Zealand. At the ripe age of 65 you can quit your job, spend your days, playing golf, doing lunch, travelling the world, doing whatever you like because at age 65 you will be entitled to New Zealand Superannuation – yeehaa! If you are married, then you can expect to get NZD$288.10 each a week…

whaaaattt???

Now I don’t know about you or your budget or living expenses… but $288.10 a week is only about $15,000 a year. If you are living in a house paying rates, power bills and insurance, driving a car around that costs about $100 to fill, buying food, some new clothes every now and then and having the occasional lunch out or trip away… $288.10 a week doesn’t go very far.

Besides I am wanting to retire about 20 years before I qualify for NZ Superannuation…

If you live on a boat – you might be able to stretch the dollars a little further. There are many blogs out there that give you a breakdown of their boating budgets. Some people are able to live super frugally on board. Sailing as much as possible to save on fuel expenses, anchoring instead of staying in marinas, eating on board instead of eating out etc. I love this concept however I want to be able to afford to rent a car and go exploring inland, stay in marina’s and hotels every now and then, be able to fly home or fly the kids out to visit etc.

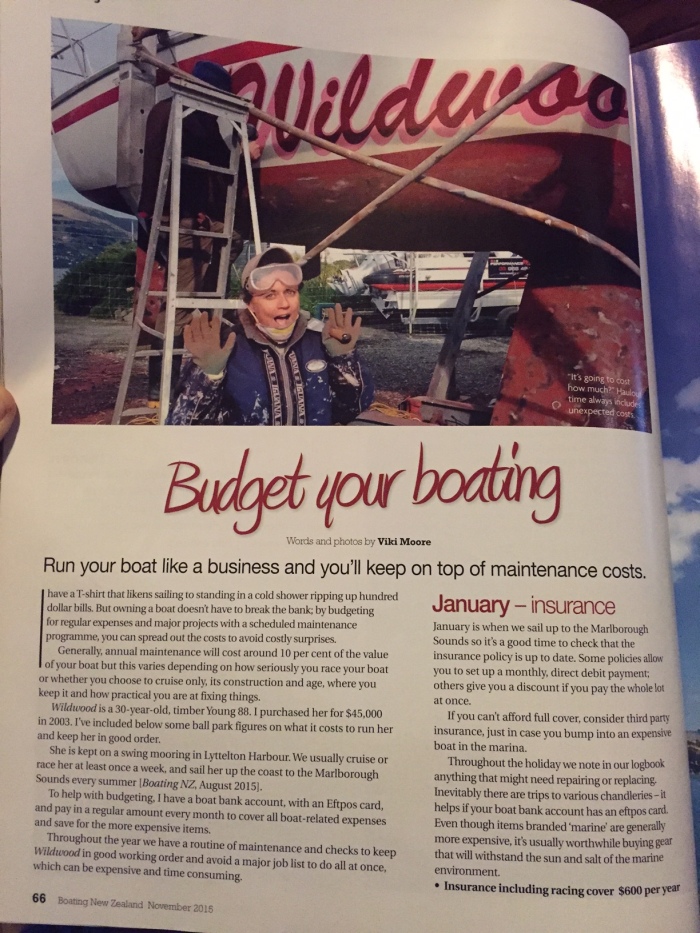

What is your sailing budget? How much income you might need will be up to you – to get an idea of how much it costs to run a boat you might like to check out my Budget your Boating article.

But where is this money going to come from? I want to retire at 45 and go sailing! I don’t want to be working if I don’t have to… Just how do you go about creating a passive income – i.e. money trickling in to your bank account without you even having to get out of bed to get it…

Have you read the legendary book – Rich Dad Poor Dad? If not you should buy it! This book has been around for years and is full of great ideas about getting your money to work for you. The sooner you can get started the better.

So what are some options for creating an income without having to go in to an office and earn it?

Firstly you might like to have a think about your net worth. Add up all your savings, properties, cars – all your assets that you could (and would) sell today and get money in the hand for. Deduct all the mortgages and loans that you have, and then you should get a $ figure. This is your net worth.

What do you own?

- House Value: $

- Yacht Value: $

- Car Value: $

- Shares: $

- Savings: $

- Other assets: $

- TOTAL: $

What do you owe?

- Mortgage on house: $

- Credit Cards: $

- Car/Boat Loan: $

- Other loans: $

- TOTAL: $

Take what you own and deduct what you owe – this is your net worth: $

Once you know how much money you already have then you can figure out how you might get your money to work for you while you go sailing (and how much more money you are going to have to save to get the income you require!)

So what is the best investment for you?

Say for example you wanted to earn NZD$40,000 a year – how much would you need to have invested? (Note that I’d like to earn more than $40k a year but I am just using that figure as an example of how to work the various investments work out).

The Bank

With worldwide interest rates at an all time low, the bank is a safe but not very appealing investment choice. At present, the best term deposit interest rate is 3.8% – and this means locking your money away for five years. (Update – its 2021 now and interest rates are currently much lower than this!).

You are going to need to deposit $1,150,000 in the bank to earn $40,000 a year.

The money is reasonably safe in the bank, but to get this high rate it is locked away for five years and it isn’t earning you a great return.

Property

I have got a love hate relationship with property. Here is what I love about it:

- You can borrow money to buy it and then borrow against the property to buy more things

- Usually the value of the property increases as the years go by

- You can live in it or rent it out

- It is insurable

- You can renovate it and increase it’s value

- Rental properties have various tax benefits (in New Zealand) if it is geared correctly then you can get tax refunds to help you pay for the expenses on the property

- When you come home from sailing then you have a property you can live in. (Once you get off the property ‘ladder’ it can sometimes be difficult to get back on again if prices are always steadily on the rise)

Yes property is cool to own. It is tangible, and if you rent it out then you can get someone else to pay off your mortgage while it quietly increases in value.

But… there are lots of things that suck about owning properties as well…

- Interest rates – you don’t have any control over these and you’re held hostage by your mortgage until you’ve paid it all off.

- Tenants – some are angels, others are down right criminals and will do their best to wreck your property and not pay their rent, and make life as difficult as possible for you. Tenancy laws are skewed in favour of the tenant

- Maintenance – houses need painting, gardens tamed, leaks fixed, all sorts of repairs that take time and money. Great if you are a handyman living nearby, not so easy if you are sailing around the world and you have to pay someone else to manage it.

- Earthquakes – oh you don’t have earthquakes? No neither did we in Christchurch until we had a huge one and all the houses got broken. Five years on, there are still people fighting with insurance companies to get their houses repaired or rebuilt.

- Vacancies – if there is a downturn in the market, then your house could sit empty for a while, how are you going to pay the mortgage if someone else isn’t?

- Other expenses – rates, insurance, interest, maintenance, property management fees – these all add up and eat in to your return.

- When you decide you want to sell it, you might not be able to sell as quickly as you had hoped.

- Some countries have capital gains taxes and stamp duty and other silly things that make property investment less desirable.

When things go well and you have got good tenants and a good property, then renting it out is fantastic and easy and worth it. But the market can change, the tenants can be idiots and this can make life very difficult.

My advice – if you are going to have a rental property – and you aren’t going to be around – have it professionally managed. You will of course pay for this, but it means that you wont have to be chasing up arrears, and organising repairs from overseas.

If you want to earn $40,000 a year from your rental property, then you are going to need to get at least $900 a week in rent. From the $900 you can deduct all the expenses, like rates, insurance, property management and maintenance, to get $769 a week in your hand (Presuming you don’t have a mortgage on the property).

You are probably more likely to get $450 a week from two separate cheaper properties – than trying to get $900 a week for a more expensive property. But then with two properties you have two lots of expenses as well… either way, you are going to have to invest well over $1,000,000 in either one or two properties to earn $40,000 a year. Remember though that you will also get capital gains as the property increases in value. but trust me – it isn’t easy money…

Shares

I started investing in the share market a couple of years ago now. It is great fun and an interesting way to earn (or lose) some money. The bank I am with has an online share trading account, so you can buy and sell until your heart is content (or you run out of money)

Now I am not an expert, and I think to be really good at this then you need to spend a lot of time researching the companies you buy shares in. You would probably need to have a good internet connection to be trading in shares on a regular basis which could be challenging while at sea. You can decide if you want to buy shares that pay dividends, or to invest in shares that are likely to increase in value. Investing in shares – i.e. buying and holding them, is different to share trading, where you might buy and sell on a regular basis.

To give you an idea, some shares that I bought have increased 138% in value! Others have decreased in 60% in value, so it is all over the place. Other more blue chip type shares just steadily increase and pay a dividend along the way as well.

I have enjoyed dabbling in the share market and if I had more time and expertise, then I think they would be a good place to invest your money, but it is all a bit too time consuming for me, so I am gradually going to sell my shares and invest in…

Managed Funds

Fund managers are experts in all things to do with the share market. They can purchase shares in local and international shares, and you can decide if you want to invest in a riskier and potentially higher earning fund, or a more conservative and stable return.

Depending on the fund you invest in, your money is usually available to be either drawn down in smaller amounts, or as a lump sum. When you are still saving you can make regular smaller deposits, or throw in larger amounts when you sell property or shares. The key is to start early and make the most of the compounding interest.

You can look back on various fund’s performance. A growth fund that I invest in made returns between 4.27% and 14% – an average of 6.44% over the last five years. Interestingly the conservative fund averaged out at 5.99% over the last five years, so not that much difference really.

So say you could get an average annual return of 6.44% then you would only need to invest $620,000 to get a return of $40,000 a year.

ONLY $620,000? That is a lot of money right…?! Well divide that by two people to make it sound more appealing – $310,000 per person. add on how much it costs to buy your boat, then sell your assets, invest them in managed funds – get saving people!

Earning on the go

Ideally we’d all like a passive income where the $$ just rolls in without you having to do terribly much. But if that isn’t practical, and your passive income isn’t enough to fund your ongoing sailing adventures, then perhaps you could make some extra money along the way?

Just make sure that you don’t break any local laws – some countries require you to have a work permit. Do your research!

Here are some ideas:

- Writing articles about your adventures and selling them to magazines.

- Writing a book – maybe about your travels, or perhaps a fictional story or a how-to guide about something you know a lot about.

- Affiliate links – recommend products on your website and get a commission when they click through a buy something. Check out my boat gift ideas post for some ideas on how this can work.

- Advertising on your website – Check out Google Adsense

- Producing sponsored posts – some companies will pay you to do a review of their products.

- Photography – sell your images online via a website called Shutterstock.

- Set up a Patreon Account. People pledge a monthly $sum for exclusive content that you provide.

- Become a delivery skipper or crew and get paid to sail boats from one place to another.

- Use your skills and work remotely – perhaps you could do small contracts when the time and internet coverage suits.

- Sell things online – great if you are crafty check out http://www.Etsy.com – you just come up with the ideas and designs and you can get other people to run your digital shop for you.

- Use your skills to help other yachties – perhaps you are a hairdresser, dentist, accountant, diesel engine mechanic, sail maker, rigging, painter, refrigeration expert etc? Remember you’ll need to abide by the local laws of the country you are in, and preferably not take business away from the locals.

- Split expenses with friends/crew – while local laws may prohibit you from taking paying passengers on board your recreational vessel, there aren’t any rules around sharing the expenses – food, fuel, maintenance etc. Check out my post on money sharing tips.

- How about renting a room on board your boat via Air B&B? Here in NZ you’d probably need to put your boat in to survey with Maritime NZ to do that though.

- Do seasonal work – you can get special work permits in New Zealand to do fruit picking for example.

- Boat-sitting – get paid to look after other people’s boats for them while they are away – good if you are going to be somewhere for a longer period of time.

Any other ideas? Let me know in the comments below.

Spending it!

After all that hard saving, you don’t want to go and spend it all in one go. So you’ll need a strategy to stretch it out.

Here are some things to think about.

- Take your total savings amount and divide that by your life expectancy and spend up to that amount every year.

- Keep your funds in three ‘buckets’

- one to cover off expenses for the next 1-3 years and include some cash for any emergencies. This could be in a normal bank account.

- The second can hold income producing investments such as bonds.

- The third to hold long term growth assets – something that is going to be earning more interest than current inflation rates.

Check out the Sorted website for all sorts of interesting templates & worksheets to figure out how much you need to save and that kind of thing.

Whether I make my target or not, whether I keep properties and rent them out or sell them and put the money in investments, I am not sure as yet. But rest assured I am saving hard to reach my target. And if I don’t quite get there – well I am going anyway. I might just have to work along the way, come home to work and top up the cruising kitty or tap in to some of the capital instead of just living on the interest/return. Either that or win lotto or something like that.

So if anyone has any great tips on how we can retire early and any other get rich quick tips – please do share so we can get going sooner. I certainly don’t want to be hanging around working for another 20 years so I can start collecting my $288.10 a week in pension…

Another great article Viki. Great advice here and it is all about mind-set and making it happen. We live cheaply on a boat, but we live so differently to most land-lubbers and it hurts (financially) when people come and stay and are in ‘holiday’ mode! Am I allowed to say that! 😉

LikeLiked by 1 person

Lol of course! Yes we certainly live up large when we are on holiday’s too. Far too much wine consumed over the Xmas period!

LikeLike

Viki, as talented a writer as you are, you should be writing a book! There’s your income stream after you retire. Really, I, and many others I’m sure, love your posts, photos and videos. You have a knack for storytelling. Best of luck on your early retirement!

LikeLiked by 1 person

Aw thank you Diane! 🙂

LikeLike

Save, save, save to by the boat was our way. We cleared our debts and did not borrow to buy a ‘toy’. A year or two away from retirement and life aboard, we don’t intend to sell assets – property that is. Fellow yachties once told us to never sell your property – Hang on to it. You won’t always be sailing full time and if you have sold, you won’t be able to get back into the market.

Still saving like crazy now to continue building the nest egg and replace gear on board so it lasts well.

LikeLiked by 1 person

Yes good point re the property market. Nice to have a home base to come back to.

LikeLike

We live (2people) with less than 10 000 aud a year. Very comfortably, because this isn’t the budget, this is what we found out we naturally spend. I guess I will have to write an article to give out a few secrets…

LikeLiked by 1 person

Wow that is fantastic. Yes! Please do! It is always interesting to hear how other people do things. There are so many variables – like there are with life on land too I guess. That figure makes my saving budget much more achievable. 🙂

LikeLiked by 1 person

The thought of NZ$288 a month is downright depressing 😦

Some great tips and food for thought here!

LikeLiked by 1 person

If only we could get your USD$1.00 beers and tacos Ellen – we would be sweet!

LikeLike

Viki: Great post and so true! Folks don’t have to work until they die before they can afford to retire. We’ve seen so many people put off retirement because they were afraid they didn’t have enough money and then were too old to enjoy it.

We retired early without as much money as “they” said we needed but decided to cut the bow lines while we were still healthy. Almost a year in, we are spending less than we thought we would but the stock market is not performing as we had hoped it would. Overall, it’s probably a financial wash. We don’t plan to cruise forever and once we return to land, we plan to find some part-time work to supplement our income.

I’d much rather have fun now and work later!!

Namasté,

Marci

S/V FNR

http://www.zenonaboat.com

LikeLiked by 1 person

Yes a good point Marci! Hardly worth waiting until you are 65 to ‘enjoy’ retirement if your health isn’t up to it. Life is too short!

LikeLike

Hi Viki,

I went cruising with the theory that I would some day return to work, rather then saving up I cashed up for a while then when back on land re-invested, things that cost more then we thought were..

1 – storing out possessions safely and away from damp

2 – kids, and kids, if aboard they cost, here’s why

3 – going ashore – its what kids want to do…

4 – going ashore again – if you avoid then then you dont spend money, I know its crazy but it works

5 – trade your time for money, help others while cruising working at things you enjoy, there are cruisers out there who have plenty of money (dam them!) and will happy pay you $150 to change their oil and fix their alternator!

If I had planned my trip then to be honest I would of not gone, you just cannot see the value, when on board you have so much time that things I was worring about I stopped worring about and found new thinks to concern me more (safe anchorage over investment returns etc) The value of the trip then hits you and stays with you for life

I dont think most people go cruising for ever, you do miss a good bath and a garden and a garrage to polish your car in, however going away for 5 years is not unreasonable and easier to budget.

So go, ASAP, while you have the energy, the money will always be there, especially for people skilled like yourself and Andy

Oh, and yes, write a book, love your blogs 🙂

Dudley,

LikeLike

Thanks Dudley for your kind words and great advice!

LikeLike